In the area of high sensitivity towards the manner in which taxpayers arrange their affairs, the purpose of the Directive (and of the Law) is to enhance tax transparency. Under the Law (certain) intermediaries and, under certain circumstances, taxpayers are required to report certain cross-border arrangements to the Luxembourg direct tax authorities (Administration des contributions directes) who will in turn share the information with the competent authorities of all other EU member states.

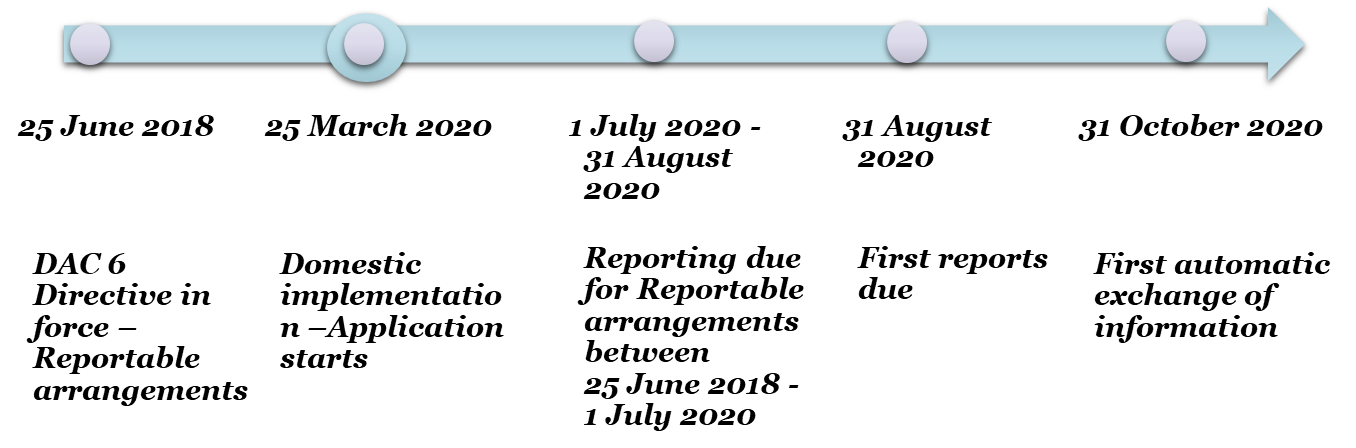

Although the Law does not extend the scope of the reporting obligations beyond what is required by the Directive, the first reporting that apply to reportable cross-border arrangements having been put in place on or after 25 June 2018 will have to be made during a period that commences on 1 July 2020 and ends on 31 August 2020.

Who needs to report?

Intermediaries / relevant taxpayers

The obligation to report reportable cross-border arrangements (explained in further detail below) lies – as a main rule – with intermediaries. However, in some specific situations the obligation to report may shift to the relevant taxpayer.

An intermediary can be either an individual or a company (such as accountants, advisers, lawyers, banks, domiciliation service providers etc.). The Law follows the Directive and provides for a fairly broad definition of an intermediary as “any person that designs, markets, organizes or makes available for implementation or manages the implementation of a reportable cross-border arrangement”.

Furthermore, an intermediary is also defined as “any person that, having regard to the relevant facts and circumstances and based on available information and the relevant expertise and understanding required to provide such services, knows or could reasonably be expected to know that they have undertaken to provide, directly or by means of other persons, aid, assistance or advice with respect to designing, marketing, organizing, making available for implementation or managing the implementation of a reportable cross-border arrangement.”

The reporting obligation applies in Luxembourg (i.e. the arrangement is to be reported to the Luxembourg tax authorities) only to the extent that the intermediary has nexus in Luxembourg (i.e. that the intermediary is either tax resident in Luxembourg, established or having a permanent establishment in Luxembourg through which the services are provided, or registered with a professional association in Luxembourg in the scope of rendering legal, tax or advisory services).

As a result of amendments proposed by the State Council, the final text of the Law extended the exemption from the reporting obligation to all intermediaries that are subject to professional secrecy requirements (in addition to lawyers, this group includes chartered accountants and auditors), provided that they act within the limits applicable to their respective profession. Intermediaries who are exempt from the reporting obligation are obliged to notify – within a period of 10 days as from the date the arrangement becomes reportable (as described below) – all other intermediaries that the reporting obligations fall on them, or in the absence of other intermediaries, the taxpayer itself.

In this case, the exempt intermediary has the obligation to provide sufficient information to the other intermediaries or to the relevant taxpayer so that such person is able to properly fulfill the reporting obligations.

What must be reported?

Reportable cross-border arrangements

Arrangements that may be subject to the reporting obligation include:

- cross-border arrangements involving either two or more EU Member States or between an EU Member State and a third-country (consequently, purely domestic arrangements do not fall within the scope of the Law and are therefore not reportable);

- in relation to one or more types of taxes referred to in article 1 of the amended Luxembourg law of 29 March 2013 on administrative cooperation in tax matters (i.e. all taxes such as corporate income tax, dividend withholding tax, municipal business tax, net wealth tax but excludes Luxembourg VAT, customs duties, excise duties and social security contributions); and

- that are covered by one (or more) of the defined so-called hallmarks as mentioned in the annex to the Law.

If an arrangement is reportable, the following information should be reported by the intermediary or the relevant taxpayer to the Luxembourg tax authorities:

- the identification of intermediaries and relevant taxpayers;

- details of the relevant hallmarks;

- a summary of the content of the reportable cross-border arrangement;

- the date of the first step of implementation;

- details of the national provisions forming the basis of the reportable cross-border arrangement;

- the value of the reportable cross-border arrangement;

- the Member States concerned by the reportable cross-border arrangement;

- the identification of any other person in a Member State likely to be affected by the arrangement.

The Law makes reference to a Grand-Ducal Regulation to be expected prepared which should offer practical guidance in relation to the form and procedures for transmitting the above information.

The information that has been reported on a cross-border arrangement will subsequently be shared by way of automatic exchange of information by the competent authorities where the reporting has taken place with the relevant authorities of all other EU Member States.

Hallmarks

A cross-border arrangement will be reportable if it meets at least one of the so-called hallmarks as defined in the annex to the Directive. The Hallmarks contain criteria that could indicate that an arrangement might entail aggressive tax planning.

The Law closely follows the Directive by transposing, in the same broad manner, the five Hallmark’s categories.

For certain Hallmark’s categories (A, B and certain elements of category C) cross-border arrangements will only be reportable if the so-called main benefit test (the “MBT”) is met. The MBT means that one of the main objectives of the arrangement is to obtain a tax advantage.

- Generic hallmarks linked to the MBT: arrangements that give rise to performance fees or involve mass-marketed schemes.

- Specific hallmarks linked to the MBT: this includes certain tax planning features, such as buying a loss-making company to exploit its losses in order to reduce tax liability. Another example involves arrangements aimed at converting income into capital in order to obtain a tax benefit.

- Specific hallmarks related to cross-border transactions: some of these hallmarks are also subject to the MBT.

- Specific hallmarks concerning the automatic exchange of information and beneficial owners.

- Specific hallmarks concerning transfer pricing.

Timing

As from 1 July 2020, reportable cross-border arrangements must be reported to the Luxembourg direct tax authorities within 30 days following the date when the reportable arrangement is (i) “made available for implementation”; (ii) “ready for implementation” or when (iii) “the first step of implementation has been made,” whichever occurs first.

Moreover, exempt intermediaries (i.e. those that fall within the scope of professional secrecy) must notify all other intermediaries involved (or the relevant taxpayer) within 10 days beginning on the date referred to above. When, due to the absence of other intermediary, the obligation fall on the taxpayer itself, the latter must report within 30 days beginning on the date referred to above to the tax authorities (to be determined based on several criteria, but in principle, of the country of tax residency).

Reporting starts from 1 July 2020, however, it will also retroactively cover cross-border arrangements where the first step has been implemented on or after 25 June 2018.

Once reported, the information regarding the arrangements will be shared by the Luxembourg tax authorities within one month following the end of the quarter during which such reporting occurred. Consequently, the first information exchanges will occur by 31 October 2020 at the latest.

Timeline

Below are the key dates regarding the implementation of the EU reporting obligation in Luxembourg.

Penalties

The Law introduces potentially high penalties of up to EUR 250 000 for intermediaries and taxpayers in case of failure to report (or to notify other intermediaries or relevant taxpayers - in case of exempt intermediaries), in case of late reporting and in case of incomplete or inaccurate reporting. It is important to note that this penalty may apply to each reportable cross-border arrangement and is hence not a maximum amount per intermediary / taxpayer.

Given that non-compliance with the reporting obligation is heavily sanctioned, further guidance from the tax authorities on the interpretation and application of the Law would be welcome.

***

We will continue to monitor the implementation of these obligations in Luxembourg.

Since the first reporting period commences already as from 1 July 2020 intermediaries and/or taxpayers will only have limited time in order to determine which cross-border arrangements fall in scope and prepare for the reporting itself. Given the potentially high penalties for failing to comply with the Directive/Law, both intermediaries and taxpayers adhere to this law strictly and may consider applying a more prudent approach in assessing which arrangements are reportable or not.

Tiberghien can assist you in assessing the impact of the Law to your specific situation. For more information, please do not hesitate to reach out to your usual contact at Tiberghien or with one of the authors.

Michiel Boeren - Partner (michiel.boeren@tiberghien.com)

Maxime Grosjean - Senior Associate (maxime.grosjean@tiberghien.com)

Maja Vulevic - Associate (maja.vulevic@tiberghien.com)